February felt like it was going to be a tough month, after the markets leapt for joy in the belief that inflation was defeated, reality needed to bite.

So it has been proven to be. The split in opinion over terminal rates (the rate at which the Fed (and other central banks) would pause hiking) is becoming less consensual. On one hand inflation from wages and shelter seem to be persistant (not falling far enough fast enough) on the other energy and food prices are declining.

Enough information for the inflation bulls and bears to feed on. The truth is we are not really sure what inflation will do. If it was caused by the unlocking post covid, then it should continue to abate. If it was caused by tensions with Russia then it will likely get worse before it gets better. If it was caused by the extraordinary monetary stimulus then it will get much worse. If it returns to its long term secular trend based on demographics it will likely fall.

Neither the Fed, nor anyone else has a good sense of where inflation will be in 12 months. While markets will continue to guess, for long term investors it should not be a driving force.

What we do know is that tensions with China, both balloon and covid related seem to be ratcheting up, this will act as a headwind to global growth. Sanctions placed on Russia that came into effect this month will also put pressure on prices in the West.

However the prospect of a de-escalation of tensions is omni present (we hope), so too the hope that Russia and Ukraine may achieve a cease fire. Both of which would be hugely positive for risk.

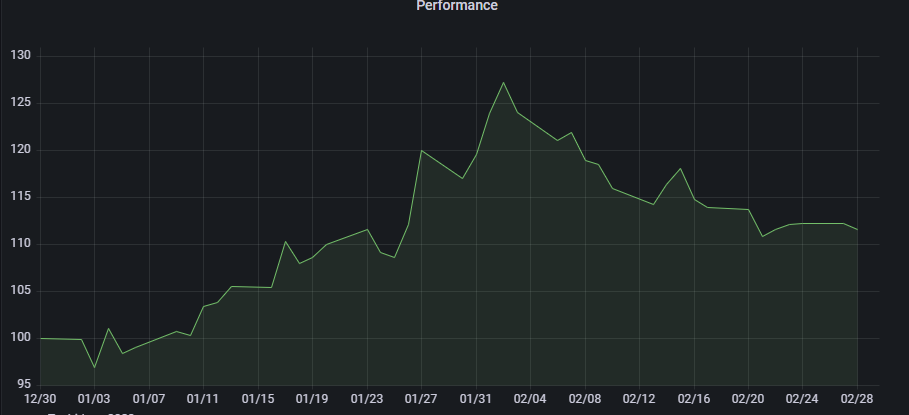

To our performance:

After an extraordinary start to the year, we gave back 8% leaving us +12% on the year with no changes to positions.

We remain 100% materially positive on our long positions (albeit Signature bank is $2k off site), our losses are coming from our short positions with 60% of our shorts losing money, the worst of which are IMI and Sandvik, both of which are up 4 and 3% (respectively) this year.

Our major winner is Tesla, ironically given its early years performance. Such is its contribution that were we to exclude it we would be approximately flat on the year, with Farfetch having given up some of its early years gains.

We will over the next months give an analysis of each company in the portfolio.

However for now, we will leave you with a company that is not included in the portfolio, but which has recieved a huge amount of commentary.

Here is to the arrival of spring (in the Northern Hermisphere!)

Have a great month.

Upside